Robinhood tax calculation

The following quarterly tax due dates have been estimated. 57652 Family Median Income.

Robinhood

Hassle-free drill down into modify and share reports Request a demo today.

. Stocks held longer than a year get taxed at the more favorable long term capital gains rates of 0 15 or 20 percent depending n your income level. Our Premium Calculator Includes. Commission-Free Trades are Everywhere.

That means that all cash proceeds including future sell orders dividends interest and certain other. As usual you are free to. Long-term capital gains have rates falling at 0 15 and 20 and the rate being dependent on your income.

Sum of all the money received from selling the shares - Sum of all the money spent on the trades EXCLUDING the ones you still hold Net Profit. Smarter Investors are Here. However if youd rather calculate all your crypto taxes together you can create a CSV file of your Robinhood crypto transaction history to upload to a crypto tax calculator like.

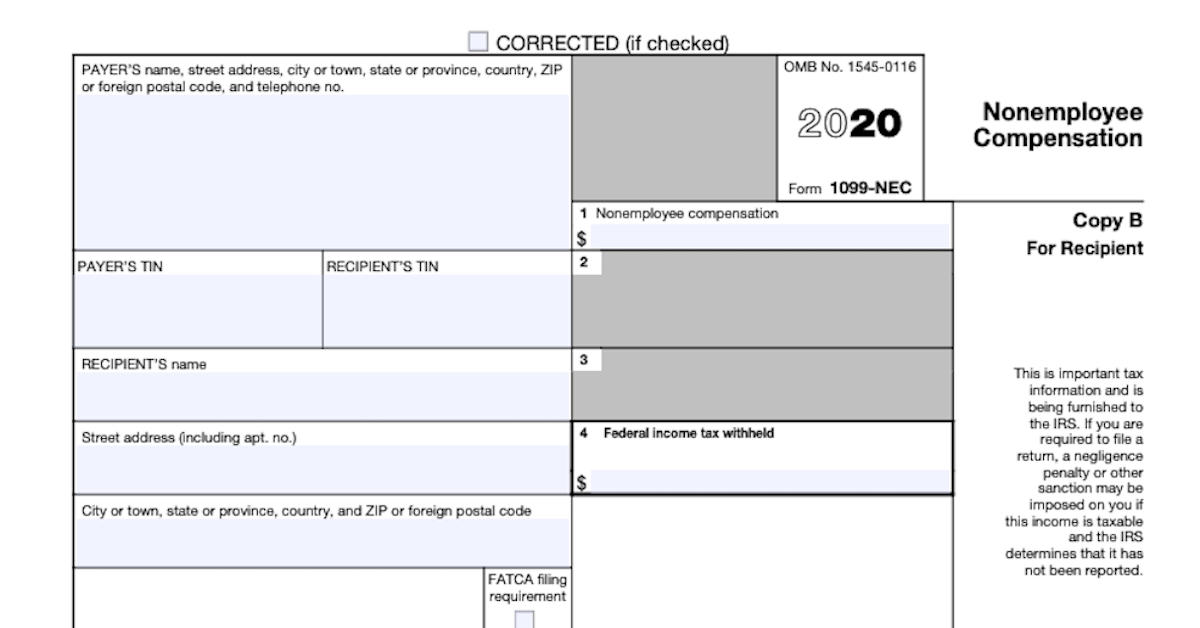

If youre a single taxpayer in 2021 the government allows you a standard deduction of 12550 25100 if married filing jointly. Get your Robinhood tax papers to file yo. Often 1099-B forms dont work for crypto.

The most straightforward approach is to use a quarterly estimated tax calculator. 46 Income per Cap. It is also an input to the Total Return calculation.

POPULATION BY OCCUPATION Agriculture forestry. Today we are talking about Robinhood taxes and where to find them. It doesnt change to reflect sell orders or the price of purchases that were transferred in via ACATS.

Theyre realized when an asset is sold after being held for more than one year and depending on your tax bracket the long-term capital gains tax rate is either 0 15 or. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. Robinhood works differently than most crypto exchanges - so youve got a couple of options for reporting your Robinhood taxes.

So in this example that would leave. Well also begin 24 backup tax withholding on your Robinhood Securities account. If you receive dividends from any of your investments theyre.

It is calculated based on buy orders only. Ad Eliminate the burdens of gathering tax data with the help of insightsoftwares solutions. This is simple but important information to know.

Our service is founded on the commitment dedication and. Robin Hood Tax Services believes in building relationships with our clients and we view these relationships as partnerships.

Etf Vs Mutual Fund Which Is Better For You Finpins Mutuals Funds Mutual Investing Apps

How Do You Pay Taxes On Robinhood Stocks

Crypto Tax And Accounting Software Libra Raises 15m In Series B Funding Planejamento De Negocios Negocios Cometer Erros

How To File Robinhood 1099 Taxes

How Do You Pay Taxes On Robinhood Stocks Picnic

Buying And Selling A Home Tips How To S Cashay Personal Finance Articles Investing Investing In Stocks

Are You Self Employed Need Help Or Have Questions Regarding Your Taxes Give Us A Call Or Send Us A Message We Can Give You A Short Consul Wise Helpful Self

What Is A Federal Income Tax 2020 Robinhood

Robinhood Taxes Explained Youtube

3

Printable 1099 Form

3

Finance Symbol Finance Finanzen Calculator Icon Accounting Sign Calculate Finance Symbol Dynamic Sha Personal Budget Budget Planner Personal Finance Books

Best Mutual Funds Mutuals Funds Fund Investing Apps

How To Read Your 1099 Robinhood

What Is A Federal Income Tax 2020 Robinhood

Beginner S Guide To Personal Finance Step By Step 2021 Personal Finance Finance Money Management